Whether Or Not you are utilizing QuickBooks for Contractors or different accounting software program, it’s essential to configure your COA properly https://www.quickbooks-payroll.org/ to meet your business’s distinctive wants. Implementing greatest practices in development accounting with QuickBooks Online (QBO) is essential for optimizing monetary administration and guaranteeing project success. By tailoring your accounting setup to the specific wants of the construction industry, you possibly can enhance accuracy, compliance, and overall monetary health.

How To Arrange A Development Chart Of Accounts (coa) In Quickbooks On-line: Greatest Practices

They can skirt the system and ignore you later if you attempt to acquire it during tax time. QuickBooks has made the process easy so that you simply can track your subcontractors. You can email the subcontractor proper quickbooks subcontractor report from QuickBooks to ask them to enter their knowledge. You can even attach their W9 form proper inside their vendor profile in QuickBooks.

- As Quickly As created, use the item in creating the bill the you will ship to your customer.

- If you find this beneficial, try this video on setting up QuickBooks On-line for job costing.

- When it’s time to issue a 1099 to your contractor, you must use the Reviews menu to generate all the necessary varieties – simply select the 1099 report and follow the instructions.

- None of those subcontractors ought to pay taxes on these reimbursable bills.

- Development bookkeeping goes past primary accounting practices by adapting to the dynamic nature of development work.

How Should A Small Development Firm Handle Its Bookkeeping With Regard To Subcontractors?

The accrual accounting method is typically used as a outcome of it records expenses and revenues when they’re incurred, not when cash changes hands, which provides a more accurate monetary picture concerning subcontractors. Development corporations could use completely different billing strategies similar to fixed-price billing, unit-price billing, or progress billing. Fixed-price billing is easy, setting a complete value regardless of the precise costs incurred.

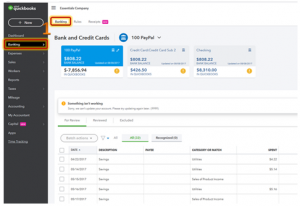

You’re additionally capable of customise completely different rates for each job to accurately observe and report on your subcontractor’s time. Yes, QuickBooks lets you monitor time and pay for subcontractors easily. Use the Bills by Vendor Summary to point out the total payments made to every subcontractor for a selected interval. QuickBooks’ custom report writer lets you create stories that meet your specific needs. This can embody information about subcontractor payments, contracts, and more.

Gross Sales reports in Methodology are totally customizable to replicate any data regarding your subcontractors, clients, workers, and more. For subcontractor reviews, QuickBooks doesn’t permit you to add custom particulars. You can personalize your reviews in some editions of QuickBooks to section subcontractors from other vendors. Then what’s the distinction between a vendor and contractor in QuickBooks?

The best apply is to meticulously document all subcontractor bills, including the total details of each transaction. Guarantee invoices are matched with work orders, and use separate expense accounts to trace these payments. For businesses that function a number of financial institution accounts or legal entities, integrating and reconciling monetary information becomes progressively complicated. Proper bookkeeping records are pivotal to navigating this intricacy, ensuring that each entity’s monetary health is accurately reflected and managed. Effectively managing payroll, particularly in building bookkeeping which may involve prevailing wage necessities, is non-negotiable. Payroll management techniques ought to accommodate fluctuating labor allocations across tasks, guaranteeing that labor costs reflect actual work performed.

The finest approach to deal with it is by establishing QBO to trace every cost towards the right job, from labor and materials to subcontractors and overhead. By the tip, you’ll perceive the means to use QBO to gain clear visibility into project efficiency and improve profitability. Efficient bookkeeping is important for construction businesses, notably when managing funds with subcontractors. With the nature of the construction trade being dynamic, maintaining correct financial information is important to a company’s development. Companies should implement efficient building accounting practices that ensure revenue and expenses are correctly tracked. In the realm of construction accounting, meticulous tracking and categorization of subcontractor bills is crucial for maintaining robust cash circulate and profitability.

The right development accounting software program assists in unifying various elements of monetary management—from job costing to billing and comprehensive financial evaluation. Select a platform that enhances the workflow and permits real-time updates. Building corporations ought to keep away from utilizing subaccounts except completely needed and hold the COA as flat as potential. Whereas subaccounts can present additional element, they often lead to confusion and errors when users post to higher-level accounts as a substitute of particular subaccounts. A flat structure reduces coding errors, makes financial reviews simpler to interpret, simplifies coaching for model new users, reduces the complexity of account choice, and minimizes posting mistakes. As An Alternative of using subaccounts, corporations ought to depend on QuickBooks’ class and location features or detailed value codes for project-specific tracking while maintaining a easy account construction.

What Construction-specific Accounts Must Be Included In A Quickbooks On-line Chart Of Accounts?

If they have bought objects for you or on behalf of your company, those usually are not wages. Integrate QuickBooks Time and Payroll modules to track the hours labored by employees and subcontractors on specific projects. This integration simplifies payroll processing and ensures that labor costs are accurately allocated to the proper initiatives or administrative duties.

By following the steps outlined on this information and implementing greatest practices, you’ll find a way to streamline your monetary management processes and achieve larger success within the development trade. Direct prices in construction embody bills which are instantly tied to particular tasks, similar to labor costs and supplies. Indirect costs, similar to overhead, may embrace office rent or utilities. Diligent tracking ensures that value allocation is precise and mirrored in job price reports. Development firms often rely on detailed cost codes to trace project-specific expenses. Ensure your cost codes (or “items” in QuickBooks) align along with your direct value accounts.

For instance, cost codes for labor, supplies, and subcontractor prices should roll up into corresponding accounts within the COA. In this text, we’ll cover best practices for setting up and sustaining a COA tailor-made for construction firms in QuickBooks Online. Verify out our Finest Practices in Creating a Chart of Accounts for a Construction Firm for a extra thorough review of basic Development COA Best Practices. Efficiently categorizing development bills in QuickBooks involves procedures for recording various forms of expenditures related to development initiatives. This consists of creating purchase orders, getting into payments, recording credit card purchases, and utilizing checks to pay for bills.